Safeguarding an Equity Loan: Actions and Needs Described

Safeguarding an Equity Loan: Actions and Needs Described

Blog Article

Utilize Your Home's Value: The Benefits of an Equity Car Loan

When taking into consideration monetary alternatives, leveraging your home's worth via an equity finance can provide a critical approach to accessing added funds. From versatility in fund usage to possible tax advantages, equity financings present an opportunity worth checking out for home owners seeking to optimize their monetary resources.

Advantages of Equity Fundings

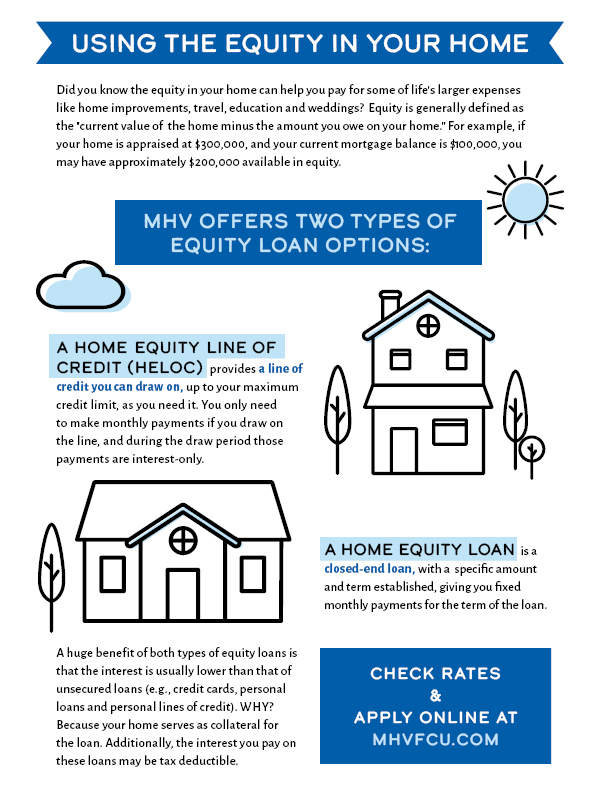

One of the main benefits of an equity finance is the ability to access a large amount of money based on the value of your home. This can be particularly advantageous for house owners that require a substantial quantity of funds for a specific function, such as home renovations, debt combination, or major expenses like medical costs or education and learning costs. Unlike various other types of financings, an equity car loan commonly offers lower rate of interest prices due to the security given by the residential property, making it a cost-effective borrowing alternative for many individuals.

Additionally, equity financings usually provide much more adaptability in regards to payment schedules and finance terms compared to various other kinds of financing. Alpine Credits Home Equity Loans. This flexibility allows consumers to tailor the finance to their financial needs and capabilities, ensuring an extra convenient repayment process. Additionally, the interest paid on equity car loans may be tax-deductible in specific circumstances, supplying potential financial benefits for the debtor. In general, the ability to accessibility significant amounts of cash at lower rates of interest with flexible repayment alternatives makes equity finances a beneficial monetary device for home owners seeking to leverage their home's worth.

Flexibility in Fund Use

Given the advantageous loaning terms related to equity lendings, property owners can successfully use the versatility in fund use to satisfy numerous economic needs and goals. Equity finances give home owners with the liberty to make use of the obtained funds for a variety of functions. Whether it's home restorations, financial obligation combination, education expenses, or unanticipated clinical bills, the flexibility of equity car loans allows people to resolve their financial requirements successfully.

Unlike some various other kinds of loans that define how the borrowed money needs to be spent, equity financings use borrowers the autonomy to designate the funds as required. Whether it's investing in a new organization endeavor, covering emergency expenses, or moneying a major acquisition, equity loans equip property owners to make critical financial decisions aligned with their goals.

Potential Tax Benefits

One of the primary tax obligation advantages of an equity funding is the ability to subtract the rate of interest paid on the car loan in certain scenarios. In the United States, for example, interest on home equity lendings up to $100,000 might be tax-deductible if the funds are utilized to boost the residential property protecting the lending.

In addition, using an equity loan to settle high-interest financial obligation might likewise lead to tax advantages. By repaying charge card financial debt or other lendings with greater rates of interest making use of an equity lending, property owners might have the ability to subtract the rate of interest on the equity funding, potentially saving a lot more cash on taxes. It's crucial for property owners to consult with a tax advisor to recognize the particular tax ramifications of an equity car loan based on their specific conditions.

Reduced Passion Rates

When exploring the financial advantages of equity lendings, another key element to take into consideration is the capacity for property owners to safeguard lower rate of interest prices - Home Equity Loan. Equity finances usually use lower passion rates contrasted to various other types of loaning, such as personal finances or credit report cards. This is since equity fundings are protected by the value of your home, making them much less high-risk for lending institutions

Reduced rates of interest can lead to significant expense savings over the life of the financing. Also a small portion difference in rates of interest can translate to substantial cost savings in interest payments. Homeowners can make use of these cost savings to settle the funding faster, develop equity in their homes quicker, or buy various other areas of their monetary profile.

In addition, lower rate of interest can boost the general affordability of borrowing versus home equity - Alpine Credits Equity Loans. With reduced passion expenses, homeowners may find it simpler to handle their regular monthly payments and maintain financial security. By making use of reduced rate of interest via an equity loan, house owners can take advantage of their home's value better to satisfy their monetary objectives

Faster Accessibility to Funds

Homeowners can accelerate the procedure of accessing funds by utilizing an equity car loan safeguarded by the worth of their home. Unlike other financing choices that might entail lengthy approval procedures, equity loans provide a quicker path to getting funds. The equity accumulated in a home functions as collateral, providing lending this article institutions better self-confidence in extending debt, which streamlines the approval process.

With equity car loans, house owners can access funds without delay, often receiving the cash in a matter of weeks. This rapid access to funds can be crucial in situations requiring instant financial backing, such as home restorations, medical emergencies, or financial debt loan consolidation. Alpine Credits Canada. By taking advantage of their home's equity, property owners can quickly deal with pushing economic requirements without extended waiting periods typically linked with various other sorts of car loans

Additionally, the streamlined procedure of equity fundings translates to quicker dispensation of funds, allowing property owners to confiscate prompt investment opportunities or handle unpredicted expenses effectively. In general, the expedited access to funds via equity fundings underscores their usefulness and benefit for homeowners looking for prompt monetary solutions.

Final Thought

:max_bytes(150000):strip_icc()/home_equity.asp-final-59af37ca6ebe48f3a1e0fd6e4baf27e4.png)

Unlike some other types of fundings that define exactly how the borrowed money should be invested, equity financings supply consumers the freedom to designate the funds as required. One of the main tax benefits of an equity lending is the ability to subtract the passion paid on the finance in specific circumstances. In the United States, for example, interest on home equity loans up to $100,000 might be tax-deductible if the funds are utilized to improve the home securing the lending (Home Equity Loans). By paying off debt card financial debt or other car loans with higher passion rates making use of an equity financing, homeowners might be able to subtract the passion on the equity loan, possibly conserving even more cash on taxes. Unlike various other financing options that may entail prolonged authorization procedures, equity lendings offer a quicker path to obtaining funds

Report this page